A Google search will reveal hundreds of companies offering to sell cryptocurrencies. Many also offer platforms to trade these currencies (so-called “coins”) - that is, buy more coin, sell, exchange between different coins and also buy other financial products on coins like futures and even options.

Starting Crypto Trading

Clients of trading venues are typically trying to make money by predicting how coin prices will change.

Buying from Coinbase

One of the larger, more established and reputable sites to purchase cryptocurrencies from is Coinbase. As I mentioned there are very many other sites, and many of them are also reputable. However, as an example, I’ll explain the process of buying from Coinbase.

Restrictions

There has been progressively greater attention given to cryptocurrencies as their total market capitalization has grown and as, unfortunately, incidents of fraud have occurred. The result is that some regulators have restricted crypto buying and trading and exchanges have increased their own security measures. By and large these are good happenings which improve investors’ confidence. However the result is some restriction on the ease of purchasing crypto.

Creating an Account

Clicking “Get started” on coinbase.com requires an email address. It also requires the user’s agreement to their conditions and to assert they are 18 or older. In subsequent parts of the process it will be required to prove this (via government ID).

Coinbase sends an email that leads to the request of a mobile (cell) phone number, which is itself verified with a code.

After this, a sequence of identity verification steps are required that will depend on the country and how much money the user wishes to deposit. Some of these will probably involve photographing government IDs (drivers licenses and passports or ID cards) and credit/debit cards, and also using a web-cam to show some of these IDs next to the user’s face.

Some of this feels quite intrusive, is frustrating to complete and can take time - possibly up to three days - to verify (if, for instance, manual verification ends up being required). Remember though that the fundamental rationale for such verification is to avoid fraud.

Depositing Fiat

Once adequately verified, it will be possible to deposit (fiat such as euro) currency into the new Coinbase account. The currency and the exact mechanism for doing this depends on the jurisdiction.

Once the fiat currency has been deposited, it will be possible to click the Trade button and buy Bitcoin. Once bought that Bitcoin will sit in a Coinbase Wallet.

Trading With BitMEX

My focus here is on how to get going with trading on one particular exchange: BitMEX. I choose this exchange because it is particularly easy to start trading there, however some explanations may be helpful on some details.

Create an Account

The first step is to create a new BitMEX account - this is straightforward via bitmex.com. Once created, click the Account link in the top line of the site and then the Deposit button. This will bring up a QR code square with a wallet id - something like 3BMEXntJX1jx64wHqkX9gF8dsqXKw9PKNV.

Add Money

It’s easy to start trading on BitMEX because all assets are held in Bitcoin, rather than any fiat currency. However of course you need the initial Bitcoin - that you may have bought on Coinbase as above.

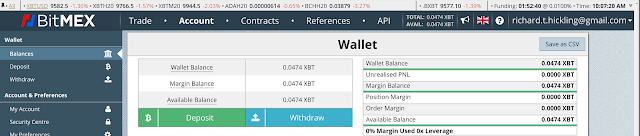

In the process of buying the Bitcoin a wallet is required. That may have been created for you on the platform where the Bitcoin was purchased (e.g. with Coinbase) or sometimes a wallet is requested to hold the Bitcoin. In that second case, provide the BitMEX wallet. Otherwise you must transfer the Bitcoin to the BitMEX wallet via a Send transaction. It will typically take minutes to hours to complete the transfer. Once there you will see it in the Wallet Balance on the Account tab (see above).

Trading

The most common way to trade on BitMEX is via Perpetual Contracts - I will restrict the discussion to these instruments for current purposes (it is also possible to trade true Futures on BitMEX). This can be surprising or confusing for new traders: “but I wanted to trade Bitcoin!” (or other coins). Don’t worry, you will get comfortable with these products and realize that it provides exactly the same exposure as buying Bitcoin would and has benefits.

Perpetual Contracts

For those familiar with futures, a Perpetual Contract can be considered a type of future that rolls automatically every 8 hours. However it is not necessary to understand these details in order to trade effectively on BitMEX.

Perpetual Contracts are associated with a coin - e.g. Bitcoin (XBTUSD contracts), Ethereum (ETHUSD) or Ripple (XRPUSD) - and designed to change in price precisely proportionally to that coin (in financial parlance, they are Delta One). Therefore if you invest a certain amount of money in a Perpetual Contract, your return will be exactly as if you had invested in the associated coin.

How To Buy

Once you have an account and Bitcoin in your BitMEX wallet, you can trade. If your objective is to buy and hold some Bitcoin, you can achieve this by entering a Buy order for the XBTUSD Perpetual Contract. In the screen shot you will see it is the Trade tab, with Bitcoin and Perpetual selected.

“20” has been entered in the Quantity field - note that it is denominated in USD - US $.

Notice that Market is selected in the Place Order pane. This means that a Buy will be at a price so that it matches the cheapest price currently asked in the market (bottom of the red Price list in the Orderbook pane). Because of competition with other traders, the exact price may be different from the cheapest ask visible. You pay a 0.075% fee when you place a Market Order.

Clicking Buy will produce a confirmation screen:

Click Buy again (clicking Don’t Show Again will avoid this step in future) and you will ‘have a long position’ in XBTUSD - you will own some Perpetual Contracts on Bitcoin.

In this example, where Quantity is 20, it means you have 20 XBTUSD contracts. Since each contract is worth $1 this is US$20 worth.

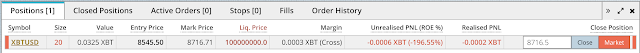

A line will appear in the Positions tab of the pane at the bottom of the window (see below) indicating this contract.

It’s important to be clear what has happened here: you now have a 20 contracts with an anonymous counterparty trader. The behaviour of those contracts is somewhat complex, however the result of them is that when the Bitcoin price increases the value of your contract increases exactly on par with it. In order to extract your profit (or stop your loss) you must close the contract.

How to Close a Contract

A Perpetual Contract is, as the name suggests, perpetual. However, for the practical purpose of trading they can be Closed. The mechanism for Closing a contract is to enter an opposite contract. In the case just described that is to enter a Sell for a contract on the same coin. The most straightforward way to do this is to click the Market button on the line for the position in the Positions tab. For the case illustrated, this will enter a Market Sell Order for 20 XBTUSD contracts. The net result of these two positions is the same as if the initial Buy contract was no longer present. No entry for the new reversing contract appears in the Positions tab however - indeed the original position disappears - but you will see a new line in the Closed Positions tab. This falls off after a period of time.

You could have the same effect by making any set of Sells (Market or Limit) of XBTUSD contracts that eventually ordered 20 Sell contracts.

Once a contract is Closed, the difference in value between the Entry price and the price of the closing trade will be added or subtracted (after fees or rebates) to your Bitcoin wallet.

Your Bitcoin Wallet Balance

You will notice that when you enter an order your Bitcoin wallet balance does not change. This is because all BitMEX orders are Margin orders: BitMEX effectively lend you the money. Your Bitcoin wallet’s contents act as collateral for the loan. BitMEX will allow you to enter into contracts up to 100 times the value of your Bitcoin wallet. If the market goes against you, there’s a process of liquidation that will result in your Bitcoin balance being reduced - or even exhausted.

Before entering into contracts that use more than your Bitcoin balance it is important to become familiar with the the risks of such trading and the BitMEX liquidation process.

Limit Orders

The above describes entering Market Orders for contracts, however you can also enter other types of order. Limit orders set a price at which you are willing to enter into a Buy contract with another trader. Entering such an order will cause a line to appear in the Active Orders tab until it is either cancelled or someone enters a matching Sell order - at which point you will have a position on those contracts.

Note that when you enter a Limit order you contribute to the exchange’s liquidity - you are a liquidity Maker - while entering a Market order makes you a liquidity Taker. While you are charged a fee for Market order (0.075%), you receive a Rebate for a Limit order of 0.025%. A good article on Limit orders can be found here.

There are several other order types - see the BitMEX documentation on them.

Short Positions

It is possible to make BitMEX Perpetual Contract Sell orders prior to any Buy orders - a so-called Short position. This is because you have a contract which behaves like the sale of the coin in terms of the return you would receive when it is Closed. The value of a Short position increases exactly by the amount that the underlying coin decreases (and decreases as it increases). This means you can speculate as freely on the Bitcoin price reducing as you can on it increasing.

Conclusion

Many aspects of trading on BitMEX have not been covered in this article. These include trading with Leverage and the Liquidation process, contracts types other than Perpetual Contracts, order types other than Market and Limit (and the fine details of these), the rolling process and Funding and the ability to trade programmatically amongst other areas - however these can be understood through the BitMEX documentation linked and many online sources.